Irs pay estimated taxes online 2021

Payment for tax due on the 2021 MI-1040 Payment in response to a 2021 Proposed Tax Due letter sent to you by the Michigan Department of Treasury Michigan Estimated Income Tax for. The deadline to file and pay your 2021 estimated taxes has passed.

When Is The Form 941 Due For 2021 Due Date Irs Forms Form

Visit Where can I get vaccinated or call 1-877-COVAXCO 1-877-268-2926 for vaccine information.

. By Phone Credit or Debt. Realty Transfer Tax Payment. The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals.

1 day agoThe monarchy holds nearly 28 billion in real estate assets as of 2021 which cannot be sold according to Forbes. Make and View Payments. Taxpayers can check out these forms for details on how to figure.

As a partner you can pay the estimated tax by. If you dont pay. Individual Payment Type options include.

Reconcile your estimated payments by e-filing a 2021 Return. The last day to pay is June 15th. The next estimated quarterly tax due date is Sept.

These individuals can take credit only for the estimated tax payments that they made. Make a payment from your bank account or by debitcredit card. Estimates were produced only because you owed more than 1000 on the 2021 return and are OPTIONAL to pay.

View 5 years of. When you have a traditional hourly or salaried job your employer withholds income taxes from your paychecks. You can pay all of your estimated tax by April.

Crediting an overpayment on your. Tom Wolf Governor C. Make an Individual or Small Business Income Payment.

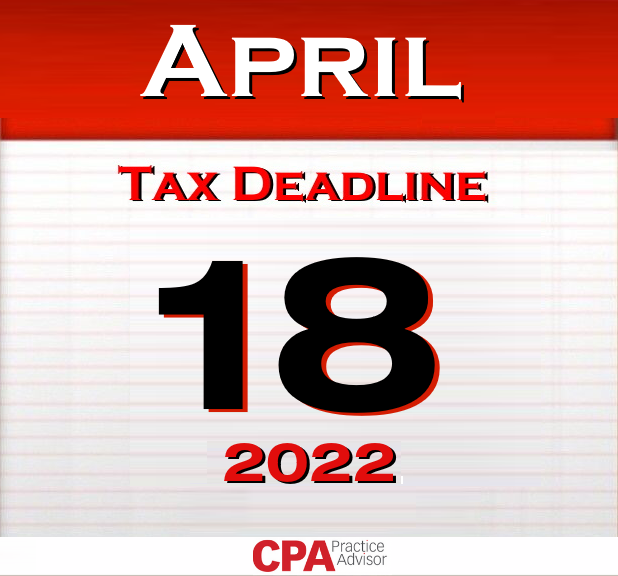

In 2021 estimated taxes are due on April 15 June 15 September 15. Those are not sent to. These were as follows for 2021 Taxes these deadlines have passed.

Make joint estimated tax payments. If you would like to make an estimated income tax payment you can make your payment directly on our website or use approved tax preparation software. If income will be greater or less than.

You can also make state tax payments by calling ACI Payments Inc at 1-800-2PAYTAX 1-800-272-9829. 2 They may file the income tax return and pay the tax in full on or before March 1 of the year following the tax year. Please be aware ACI Payments Inc charges a 249.

Personal Income Tax Payment. An estimated payment worksheet is. The final quarterly payment is due January.

How do I pay my 2021 estimated taxes online. You cant pay your 2021 taxes online until after this date. Scheduling tax payments for 2020 and 2021 was a breeze.

The final two deadlines for paying 2021 estimated payments are September 15 2021 and January 15 2022. You must pay at least 90 of your tax liability during the year by having income tax withheld andor making timely payments of estimated tax. Web Pay Make a payment online or schedule a future payment up to one year in advance go to ftbcagovpay for.

April 15 2021 for income earned January. You can also make a guest payment without logging in.

Estimated Tax Payments Youtube

Irs Tax Payments Arrcpa

How To Pay Your Estimated Taxes Online With The Irs Quarterly Taxes Youtube

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

How To Electronic Estimated Tax Payments To The Irs With Peace Of Mind Accounting Cpa Firm Minneapolis Tax Preparation Services St Paul Mn

Irs Tax Payments Arrcpa

Pin On Hhh

Tax Filing 2021 Performance Underscores Need For Irs To Address Persistent Challenges U S Gao

How To Pay Federal Estimated Taxes Online To The Irs In 2022 Estimated Tax Payments Online Taxes Tax Help

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Irs Offers Multiple Ways To Pay

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

How To Pay The Irs Online Pay Income Taxes Pay The Irs Taxes Online By Mail Pay 1040 Online Youtube

Tas Tax Tip Paying The Irs Tas

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Faqs On Penalty For Underpayment Of Estimated Tax Https Www Irstaxapp Com Faqs On Penalty For Underpayment Of Estimated Tax Tax Tax Deductions Coding